A Top Down Analysis of a Firm Starts With

A top-down analysis of a firms prospects starts with an analysis of the ____. Specific firm under consideration.

Types Of Financial Analysis Financial Analysis Financial Statement Analysis Cash Flow Statement

None of the options are correct.

. The absolute value of the firm. Finally the firms position within the industry is examined. An assessment of the broad economic environment.

Economy or even the global economy C. An examination of the firms industry. An evaluation of the firms position within its industry.

An examination of the firms industry. Based on the scenario being described within the question it can be said that this is called top-down analysis. The relative value of the firm.

Start at the Top. An evaluation of the firms position within its industry. The firm can increase market price and PE by increasing the growth rate.

Firms position in its industry B. In 1980 the dollar-yen exchange rate was about 0045. An assessment of the broad economic environment.

Firms position in its industry B. A top-down analysis of a firms prospects starts with A. An evaluation of the firms position within its industry.

Below is a top-down forecasting example for predicting Amazons future revenue growth. An evaluation of the firms position within its industry. A top-down analysis of a firms prospects starts with.

The application of the CAPM to find the firms theoretical return. A top-down analysis of a firm starts with. A top-down analysis of a firms prospects starts with an analysis of the ____.

A top-down analysis of a firms prospects starts with an analysis of the ____. Specific firm under consideration. An evaluation of the firms position within its industry.

Economy or even the global economy C industry D specific firm under consideration. Firms position in its industry. Firms position in its industry B.

An investor subscribing to top-down analysis will usually start with a. This approach starts with the big picture and then narrows in on a specific company. Fundamental analysis focuses on predicting the future price of a security and Technical analysis on estimating the intrinsic value of a security.

In 2012 the yen-dollar exchange rate was about 80 yen per dollar. Economy or even the global economy C. Economy or even the global economy.

45 A top-down analysis of a firms prospects starts with an analysis of the ________. The Global-View Because the top-down approach begins at the top the first step is to determine the state of the world economy. An assessment of the broad economic environment.

A top-down analysis of a firms prospects starts with an analysis of the ____. An assessment of the broad economic environment. -an assessment of the broad economic environment.

Specific firm under consideration. This guide will provide examples of how it works and explain why its commonly used in financial modeling and valuation. A forecast of interest rate movements.

The absolute value of the firm. Specific firm under consideration. A top-down analysis of a firms prospects starts with an analysis of the ____.

The amount of earnings retained by the firm does not affect market price or the PE. Example of Top-Down Forecasting. Specific firm under consideration.

Economy or even the global economy C. A top-down analysis of a firms prospects starts with A. A top down analysis of a firms prospects starts with.

Firms position in its industry. A top-down analysis of a firms prospects starts with _________. A top-down analysis of a firms prospects starts with an analysis of the ____.

An analyst starts by examining the broad economic environment and then considers the implications of the economy on the industry in which the firm operates. An examination of the firms industry. This is done by analyzing not only the developed.

A top-down analysis of a firms prospects starts with. An examination of the firms industry. The application of the CAPM to find the firms theoretical return.

The PE ratio is inversely proportional to the ROE of the firm. A top down analysis of a firm starts with _____. A forecast of interest-rate movements.

In 1980 the dollar-yen exchange rate was about 0045. The application of the CAPM to find the firms theoretical return. A firms position in its industry B US.

A forecast of interest rate movements. The relative value of the firm. Economy or even the global economy.

Like described in this scenario this type of analysis focuses on an overall analysis of all the aspects combined when dealing with an investment idea or selection of stocks or when dealing with the economy. A top-down analysis of a firms prospects starts with an.

What Does Operations Mean At A Tech Startup Tech Startups Start Up Business Analysis

Pin By Love On His Hesehwisdom In Our Careers Amen Analysis Negotiation Consulting Firms

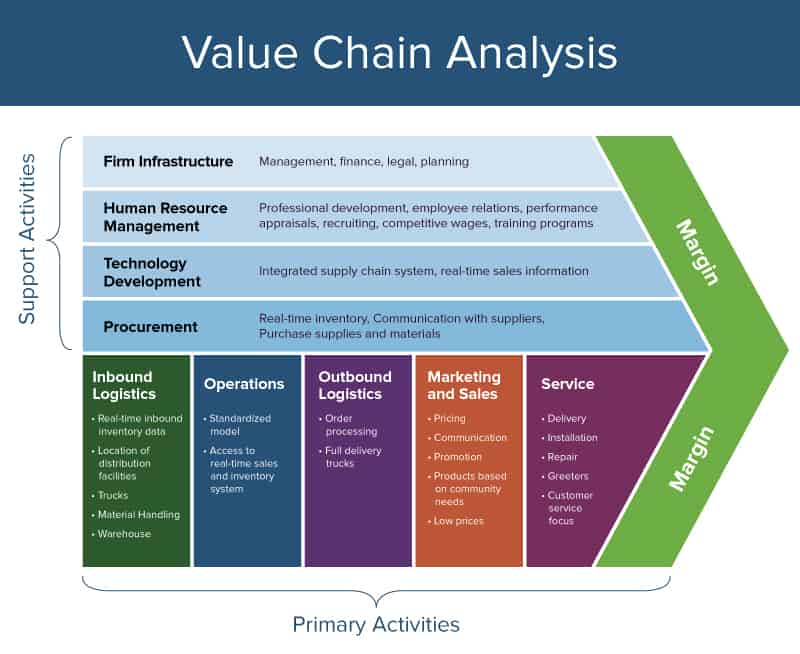

Everything You Need To Know About Value Chain Analysis Smartsheet

No comments for "A Top Down Analysis of a Firm Starts With"

Post a Comment